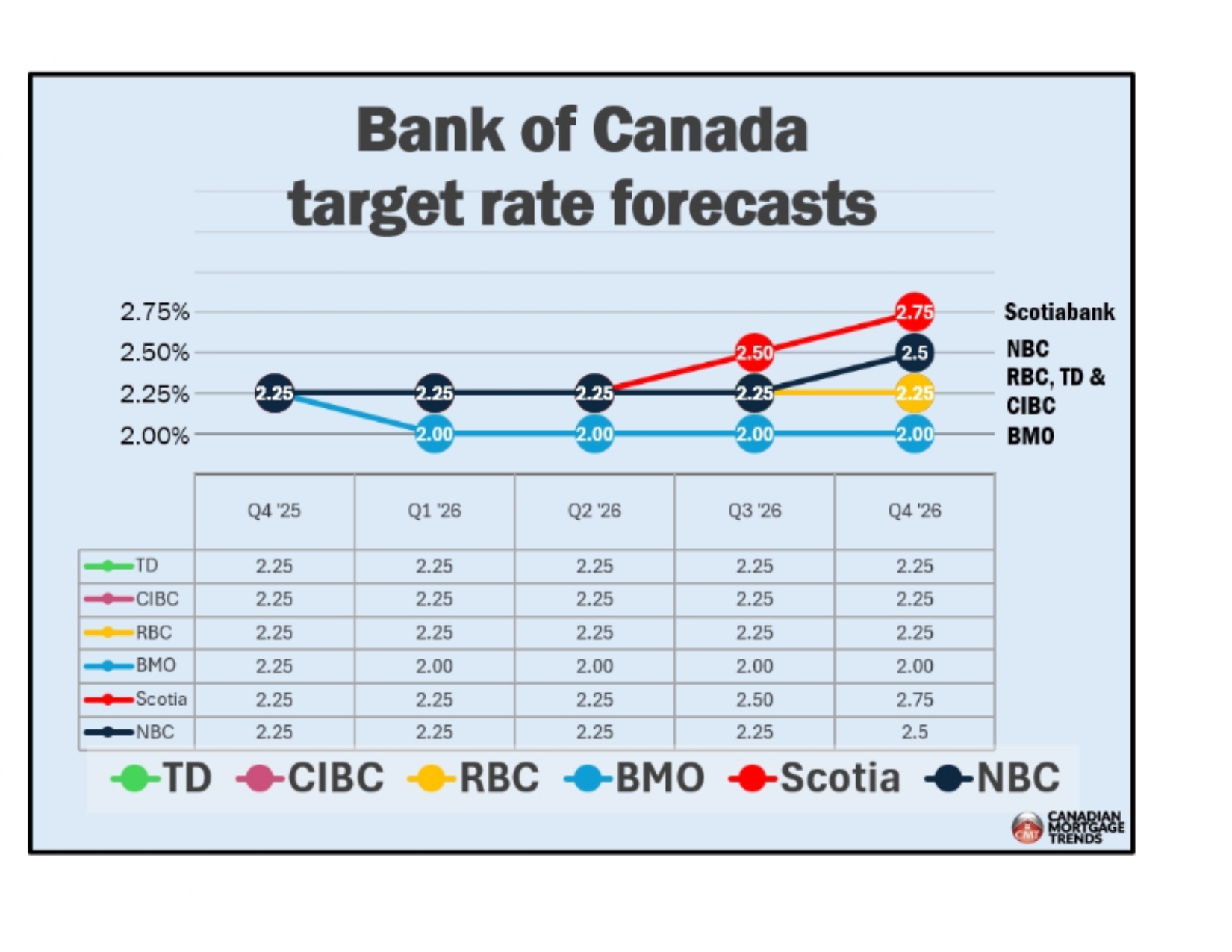

🏦 Bank of Canada Rate Forecast Update – October 2025

The Bank of Canada continues its cautious approach to monetary easing as inflation remains above target but shows steady improvement. Analysts project the overnight lending rate to gradually decline through mid to late 2026, reflecting slowing economic growth and stabilizing core inflation.

📊 Key Highlights:

-

Current Policy Rate (October 2025): 4.25%

-

Projected Rate (End of 2025): 4.00%

-

Projected Rate (Mid-2026): 3.50%

-

Inflation expected to return near the 2% target by late 2026

-

GDP growth forecast remains below 1% through early 2026

💡 What This Means for Homeowners & Buyers:

Lower interest rates over the next 12–18 months could ease borrowing costs, improve mortgage affordability, and support a gradual rebound in housing demand across Ontario and the Niagara Region.

For Fort Erie and Niagara homebuyers, this forecast signals improving conditions for both first-time buyers and move-up purchasers heading into 2026.

#BankOfCanada #InterestRates #MortgageRates #NiagaraRealEstate #FortErieHomes #BarbaraScarlettBroker #ScarlettRealEstateGroup #Century21HeritageHouse #CanadianEconomy #RealEstateMarketUpdate #NiagaraRegion #FortErieLiving #HomeBuyingTips

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link