Grateful and humbled 🖤

Grateful and humbled 🖤

Honoured to receive the Century 21 Outstanding Achievement – Award of Excellence for Q3 2025.

Thank you to my amazing clients, colleagues, and community for your continued trust and support. 🙏✨

hashtagGratefulHeart hashtagCentury21 hashtagAwardOfExcellence hashtagBarbaraScarlett hashtagScarlettRealEstateGroup hashtagFortErieRealEstate hashtagNiagaraRealEstate

Just a short month ago…

Just a short month ago…

I filmed this quick video while sitting on the back of my boat. 🚤

The air was warm,

the docks still full,

and fall was just beginning to hint at its arrival.

Now, a few weeks later,

the boat’s tucked away,

the air is crisp,

and the season has fully shifted.

There’s a stillness to this time of year—

the rush of summer gone,

the water quieter,

the days shorter.

But looking back,

it’s a reminder of how quickly seasons change—

in boating, and in life.

Each chapter asks for something different—

a little more stillness,

a little more gratitude,

a little more balance.

What’s your favourite fall ritual that helps you reset and reflect?

👇 I’d love to hear.

#BoatingLife #LakeErieLife #FortErieLiving #FallReflection #BalancedLiving #SlowLivingMovement #WaterfrontVibes #SimpleJoys #LifeInBalance #BoatingSeason #NiagaraRegion #JoyInTheJourney #RealtorLife #RealEstateLifestyle #SeasonsShift

It hit me mid-walk last night… how much beauty lives right here, in the ordinary.

It hit me mid-walk last night… how much beauty lives right here, in the ordinary.

Blue and I went out for a walk.

Nothing fancy — just the usual route.

But everything around us felt… full.

One neighbour had a Halloween display lit up just right.

One neighbour had a Halloween display lit up just right.

Another had a movie projected on the side of the house for their kids.

Another had a movie projected on the side of the house for their kids.

The air was soft.

The air was soft.

And here I was — out in a T-shirt in October, walking along a brand-new bike path…

just feeling it.

Grateful.

Grounded.

Present.

Sometimes beauty doesn’t announce itself.

You just have to be still long enough to notice it.

No big moment. Just a real one.

Wishing you a peaceful day —

I hope you catch a moment like this too.

#GodMoment #EverydayGratitude #WalksWithBlue #FortErieLife #SimpleJoys #RealEstateWithHeart #WomenInRealEstate #NiagaraRealtor #StillnessSpeaks #OrdinaryMagic #PresenceOverPerfection #RootedLiving #MindsetReset #EveningWalks #TShirtInOctober

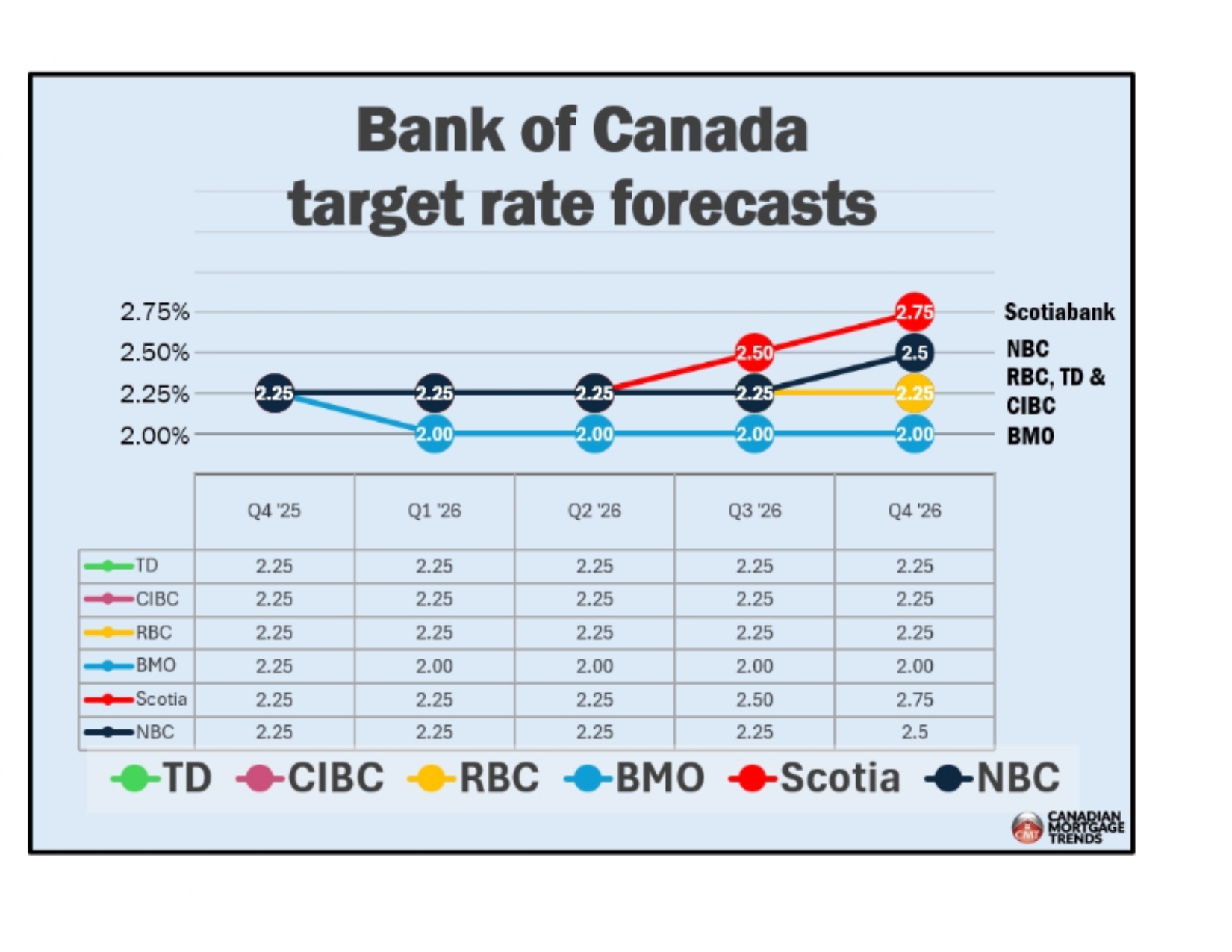

🏦 Bank of Canada Rate Forecast Update – October 2025

🏦 Bank of Canada Rate Forecast Update – October 2025

The Bank of Canada continues its cautious approach to monetary easing as inflation remains above target but shows steady improvement. Analysts project the overnight lending rate to gradually decline through mid to late 2026, reflecting slowing economic growth and stabilizing core inflation.

📊 Key Highlights:

-

Current Policy Rate (October 2025): 4.25%

-

Projected Rate (End of 2025): 4.00%

-

Projected Rate (Mid-2026): 3.50%

-

Inflation expected to return near the 2% target by late 2026

-

GDP growth forecast remains below 1% through early 2026

💡 What This Means for Homeowners & Buyers:

Lower interest rates over the next 12–18 months could ease borrowing costs, improve mortgage affordability, and support a gradual rebound in housing demand across Ontario and the Niagara Region.

For Fort Erie and Niagara homebuyers, this forecast signals improving conditions for both first-time buyers and move-up purchasers heading into 2026.

#BankOfCanada #InterestRates #MortgageRates #NiagaraRealEstate #FortErieHomes #BarbaraScarlettBroker #ScarlettRealEstateGroup #Century21HeritageHouse #CanadianEconomy #RealEstateMarketUpdate #NiagaraRegion #FortErieLiving #HomeBuyingTips

Thanksgiving at our house. 🍁

Thanksgiving at our house. 🍁

Some years, the table stretches from one side of the house to the other.

This year, it was smaller—

more intimate—

everyone gathered around my dining room table.

But the joy? Still the same. ❤️

I love the prep as much as the meal itself—

the early morning organization,

being alone in the kitchen,

timing every dish just right,

and calling on Alex when I need a hand.

Adam took care of the star of the show this year—

the prime rib—

and he did it perfectly.

Thank you @Oliversbutcherandcatering!

By the time everyone arrived,

the house smelled like tradition.

🍴 Menu Highlights

Appetizers

• Shrimp & cocktail sauce

• Charcuterie board

Dinner

• Prime rib (prepared by Adam!)

• Burgundy mushrooms

• Fresh pumpkin bread

• Scalloped potatoes

• Squash, turnips & carrots

Dessert

• Apple crisp

• Pecan pie with whipped cream

I truly love the morning hustle—

the cooking, the cleaning,

and the quiet before the company arrives.

Because that’s what Thanksgiving is about for me:

family, food, gratitude,

and the joy found in every small, meaningful detail.

How was your Thanksgiving table this year—big or small?

👇 I’d love to hear how you celebrated.

#ThanksgivingWeekend #FamilyTraditions #FortErieLife #NiagaraRegion #HomeIsEverything #BalancedLiving #SimpleJoys #LifeInBalance #JoyInTheJourney #HolidayHosting #CookingWithLove #RealEstateLifestyle #AutumnVibes #GratitudeSeason #TableGatherings

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link