Failure Will Never Overtake Me: A Testament to Perseverance

In the words of the esteemed author Og Mandino, “Failure will never overtake me if my determination to succeed is strong enough.” This powerful statement serves as a beacon of motivation, particularly as we embark on another week, navigating through challenges and opportunities alike. It’s a reminder that the essence of success is not found in never failing, but in rising every time we fall, driven by an unwavering determination to succeed.

The Role of Determination in Overcoming Failure

Determination is the steel frame that holds the foundation of success. It is what propels us forward, even when the odds are stacked against us. In the realm of real estate, this determination is crucial. The market is ever-changing, filled with uncertainties and complexities. It demands resilience, patience, and a steadfast commitment to one’s goals. Barbara Scarlett, a name synonymous with excellence in the Century 21 Today Realty Ltd. sphere, embodies this ethos. Her journey is a testament to what determination can achieve, navigating through the highs and lows of the real estate market with grace and perseverance.

Turning Setbacks into Stepping Stones

Setbacks are an integral part of any journey. They test our resolve, challenge our strategies, and often, teach us the most valuable lessons. The key is to view these setbacks not as insurmountable obstacles but as stepping stones to greater success. Every failure carries with it the seed of an equivalent success. It is our determination that enables us to find that seed, nurture it, and watch it grow into a triumph.

Cultivating a Mindset for Success

Success begins in the mind. Cultivating a positive, determined mindset is crucial. It’s about more than just avoiding negativity; it’s about actively fostering an attitude of resilience and optimism. This mindset becomes our greatest ally in the face of adversity, enabling us to maintain our focus on our goals, even when the going gets tough.

Embracing the Journey

The path to success is a journey, not a destination. It’s a journey marked by constant learning, growth, and evolution. Embracing this journey, with all its ups and downs, is vital. It’s about celebrating the small victories, learning from the setbacks, and always moving forward, one step at a time.

As we move forward into the week, let us carry with us the wisdom of Og Mandino. Let us remind ourselves that our determination to succeed is the most powerful weapon against failure. In the world of real estate and beyond, it is this determination that shapes our destiny, turning dreams into reality.

Barbara Scarlett and the team at Century 21 Today Realty Ltd. stand ready to guide you through this journey, armed with expertise, experience, and an unwavering commitment to your success. Together, we can navigate the complexities of the market, turning every challenge into an opportunity for growth and every failure into a stepping stone towards success.

Foodie Friday Delight: A Culinary Adventure at Garden Houzz in Port Colborne

On a quest for a new dining experience this Foodie Friday, we stumbled upon a hidden gem nestled in the heart of Port Colborne – Garden Houzz. This charming restaurant promised an evening filled with delectable dishes, fine wine, and the kind of laughter that only good company can bring. Let me take you through a night at Garden Houzz, a place where culinary dreams find their home.

The Ambiance

As we stepped into Garden Houzz, we were greeted by an ambiance that effortlessly blended elegance with a cozy, inviting atmosphere. The restaurant’s decor, inspired by the lush gardens of Port Colborne, featured an array of plants and flowers, creating a serene dining environment. Soft, ambient lighting and gentle music added to the enchanting setting, making it the perfect backdrop for an unforgettable evening.

The Culinary Experience

The menu at Garden Houzz was a testament to the creativity and passion of its chefs. With a focus on farm-to-table freshness, each dish was a celebration of local produce and flavors. We started our culinary journey with a selection of appetizers, including a velvety pumpkin soup and a vibrant beet salad, each bite bursting with the essence of autumn.

For the main course, the seared scallops on a bed of creamy risotto caught my eye, while my companions were tempted by the herb-crusted lamb rack and the wild mushroom tagliatelle. Each dish was artfully presented, marrying flavors in a way that spoke to the chefs’ mastery and love for food.

The Wine Selection

No Foodie Friday is complete without the perfect pairing of wine, and Garden Houzz’s selection did not disappoint. With an extensive wine list that showcased both local vineyards and international favorites, we found the perfect complements to our meals. The knowledgeable staff helped us navigate the options, ensuring each sip enhanced the flavors of our dishes.

The Laughter and Memories

What truly set the evening apart was the laughter that filled the air. Garden Houzz, with its warm ambiance and exceptional service, created the perfect setting for stories to be shared and memories to be made. As we dined, the stress of the week melted away, replaced by a sense of joy and contentment.

Final Thoughts

Garden Houzz in Port Colborne is more than just a restaurant; it’s a destination for those seeking a dining experience that feeds the soul as well as the body. As we left, we carried with us not just the satisfaction of a meal well enjoyed but the promise of returning to this charming hidden gem. For anyone looking to elevate their Foodie Friday, Garden Houzz is a must-visit. Here’s to many more nights filled with laughter, good eats, and the discovery of hidden culinary treasures.

Demystifying Real Estate: Busting Common Misconceptions with Barbara Scarlett

In the ever-evolving world of real estate, knowledge truly is power. Yet, amidst the flood of information, certain myths and misconceptions persist, steering potential buyers and sellers in the wrong direction. Barbara Scarlett is here to set the record straight. By shedding light on these common fallacies, we empower ourselves to make informed decisions. Let’s dive into the misconceptions that Barbara Scarlett wants you to forget and why sharing this video could be the key to unlocking your real estate potential.

Misconception 1: You Need a 20% Down Payment

One of the most daunting misconceptions is the belief that purchasing a home requires a 20% down payment. This myth can deter first-time buyers who feel saving up that amount is out of reach. However, numerous programs offer lower down payment options, some as little as 3-5%, making homeownership more accessible than many realize.

Misconception 2: It’s Always Better to Buy Than Rent

“Buying a home is always better than renting.” While homeownership comes with its advantages, it’s not the ideal path for everyone. Renting can offer flexibility, less maintenance responsibility, and the freedom to move without the commitment of a mortgage. The best choice depends on your personal circumstances, financial situation, and long-term goals.

Misconception 3: The Real Estate Market Is Predictable

Many enter the real estate market with the expectation that it behaves predictably, following a set pattern of rises and falls. However, the reality is that the market is influenced by a multitude of factors, including economic conditions, interest rates, and local demand, making it inherently unpredictable. Buyers and sellers must stay informed and adaptable.

Misconception 4: Spring Is the Best Time to Sell

“Spring is the best time to sell your home.” This belief stems from the idea that gardens are in bloom and properties look their best. While it’s true that the market can be busier in spring, the best time to sell depends on various factors, including market conditions, competition, and personal timing. Sometimes, selling in an “off-peak” season can result in quicker sales and higher prices due to less competition.

Misconception 5: Home Improvements Always Increase Value

Investing in home improvements before selling is often believed to significantly increase a property’s value. While strategic updates can enhance appeal, not all improvements offer a return on investment. Some high-cost renovations may not substantially raise the home’s value, emphasizing the importance of researching and prioritizing updates that will.

Knowledge Is Your Best Tool

In the intricate dance of real estate transactions, being armed with accurate information is invaluable. By debunking these common misconceptions, Barbara Scarlett encourages buyers and sellers to approach the market with confidence and clarity.

Sharing this video isn’t just about correcting false beliefs; it’s about empowering friends, family, and followers with the knowledge to navigate their real estate journeys successfully. Remember, in the world of property buying and selling, being informed is not just an advantage—it’s a necessity.

Thirsty Thursday Vibes: Mastering the Lychee Martini à la Khloé Kardashian

When it comes to setting the tone for an unforgettable Super Bowl weekend, nothing does it quite like a celebrity-inspired cocktail. This Thirsty Thursday, we’re diving into the elegant world of Khloé Kardashian with her favorite: the Lychee Martini. Perfect for adding a touch of glam to your game day celebrations, this cocktail is not just a drink but a statement. Let’s embark on a mixology adventure and craft this exquisite, celebrity-approved concoction. Cheers to a sparkling Super Bowl weekend!

The Appeal of the Lychee Martini

The Lychee Martini is a cocktail that balances sweetness and tartness with the exotic, fragrant lychee fruit at its heart. Its appeal lies in its simplicity and the sophisticated flavor profile that makes it a hit at any gathering. Whether you’re hosting a Super Bowl party or looking for a chic drink to unwind with, the Lychee Martini promises a refreshing and stylish experience.

Ingredients You’ll Need

- Vodka (2 oz) – The clean, smooth base of your martini.

- Lychee Juice (1.5 oz) – For that sweet, floral note.

- Vermouth (A dash) – To add depth to your cocktail.

- Whole Lychees – For garnish, to enchant your senses visually and tastefully.

- Ice – To chill and dilute your martini to perfection.

Crafting Your Cocktail

- Chill Your Glass: Begin by chilling your martini glass in the freezer. A cold glass will ensure your cocktail stays refreshing from the first sip to the last.

- Mix: In a shaker, combine the vodka, lychee juice, and a dash of vermouth over ice. The key is to find high-quality lychee juice for that authentic, aromatic flavor that Khloé Kardashian loves.

- Shake: Give it a vigorous shake. This not only chills the mixture but also dilutes it slightly, softening the alcohol’s bite and enhancing the lychee’s sweetness.

- Garnish: Strain your beautifully crafted martini into the chilled glass. Garnish with a whole lychee (or even a lychee on a skewer) for that extra touch of elegance and a nod to the cocktail’s star ingredient.

- Serve and Enjoy: Present with a flourish. Whether you’re toasting to your favorite team’s victory or simply celebrating the weekend, this Lychee Martini is sure to elevate your Super Bowl festivities.

Why It’s Perfect for Super Bowl Weekend

The Super Bowl is more than just a game; it’s a cultural moment that brings people together over great food, exciting entertainment, and, of course, delightful cocktails. The Lychee Martini, with its glamorous appeal and refreshing taste, offers a unique way to celebrate, setting your party apart from the typical beer and wings combo (though those are great, too!).

Final Thoughts

This Thirsty Thursday, embrace the elegance and excitement of the Super Bowl weekend by mixing up Khloé Kardashian’s favorite Lychee Martinis. It’s a simple yet sophisticated choice that’s sure to impress your guests and make your celebration unforgettable. Here’s to crafting cocktails that are as spectacular as the game day itself. Cheers!

Market Insights: Navigating the Real Estate Noise with Confidence

In the bustling realm of real estate, the market is often flooded with opinions, speculations, and so-called “expert” advice. It’s easy to get caught up in the noise, especially when you’re both buying and selling in the same market. However, the key to navigating this complex landscape with assurance lies in one crucial strategy: trusting the stats. 💼📊

Why Stats Matter

Real estate markets are dynamic, influenced by a myriad of factors including economic indicators, interest rates, and local demand. In such an environment, data and statistics offer a beacon of clarity. They provide objective insights into market trends, pricing, and inventory levels, allowing you to make informed decisions based on actual market conditions rather than speculation.

The Risk of Following the Crowd

Following popular opinion or getting swayed by anecdotal experiences can be risky. The market sentiment can shift rapidly, and what worked for someone last month might not yield the same results today. Relying on hard data minimizes this risk, giving you a solid foundation for your real estate strategy.

Buying and Selling in the Same Market

When you’re both a buyer and a seller, understanding the market dynamics becomes doubly important. This dual role can be challenging, but it also offers unique advantages. By analyzing the stats, you can identify the optimal timing for listing your property and making your new purchase. This approach enables you to align both transactions with current market trends, potentially maximizing your returns and ensuring a smoother transition.

Where to Find Reliable Stats

Not all sources are created equal. For accurate and up-to-date market statistics, consider the following:

- Local Real Estate Boards: They regularly publish reports on market activity, including sales volumes, median prices, and inventory levels.

- Real Estate Websites: Many offer comprehensive market analysis tools and neighborhood-specific data.

- Professional Real Estate Agents: A knowledgeable agent can provide insights into the local market dynamics and help interpret the data.

Watching the Full Video

For a deeper dive into why stats should be your go-to source for real estate decisions, don’t miss the full video on YouTube. It’s packed with valuable insights, tips, and real-world examples that underscore the importance of data-driven decision-making in real estate.

In a market where opinions are plenty but factual insights are gold, arming yourself with the right information is key. Trust the stats, ignore the noise, and approach your real estate transactions with confidence and clarity. Watch the full video now, and take the first step towards mastering the art of buying and selling in today’s market. Don’t miss it!

Love Your Home: Valentine’s Trends in Fort Erie’s Market – February 2024

February, the month of love, often sees a unique shift in real estate interests. Explore how Valentine’s Day impacts home buying and selling trends in Fort Erie, within the Niagara region.

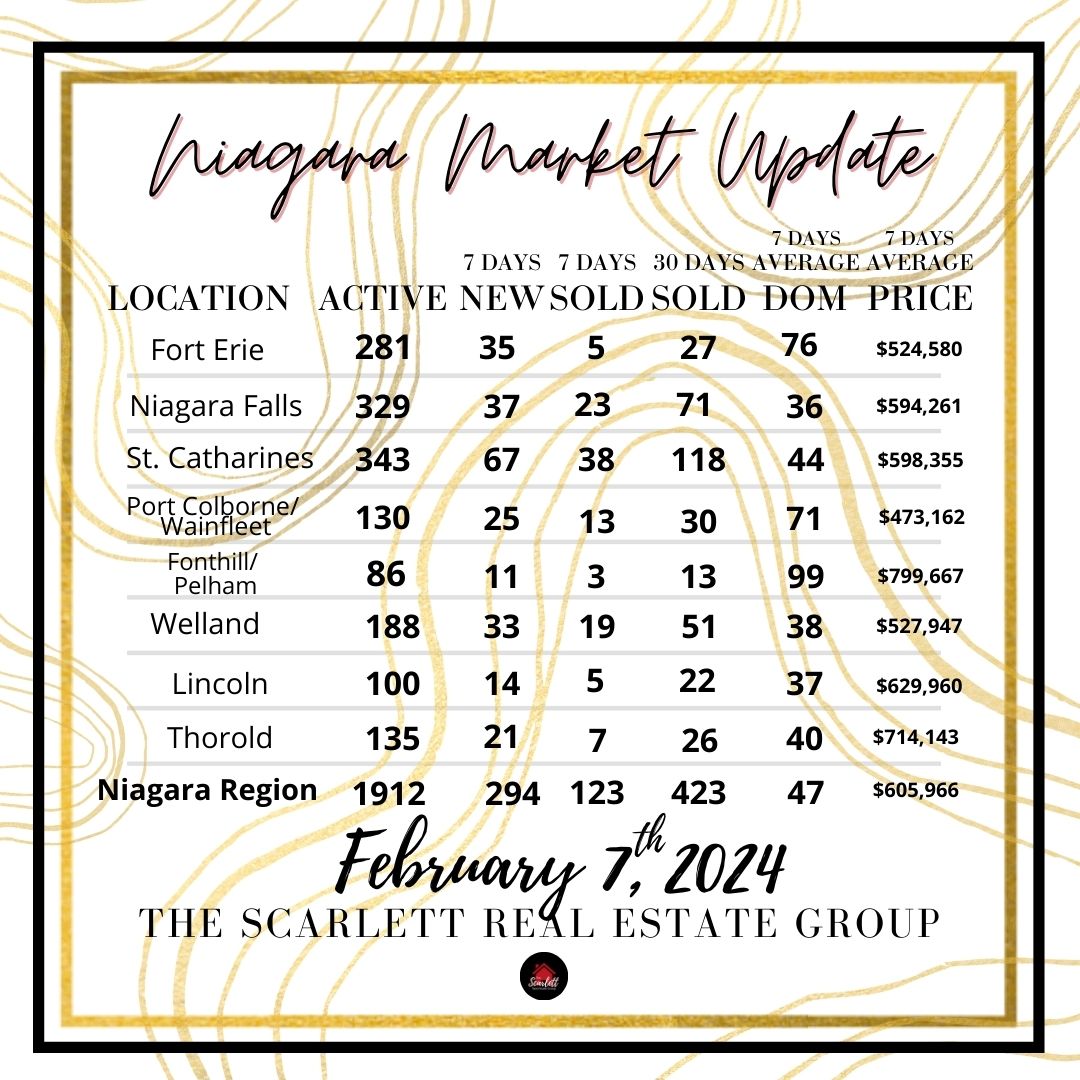

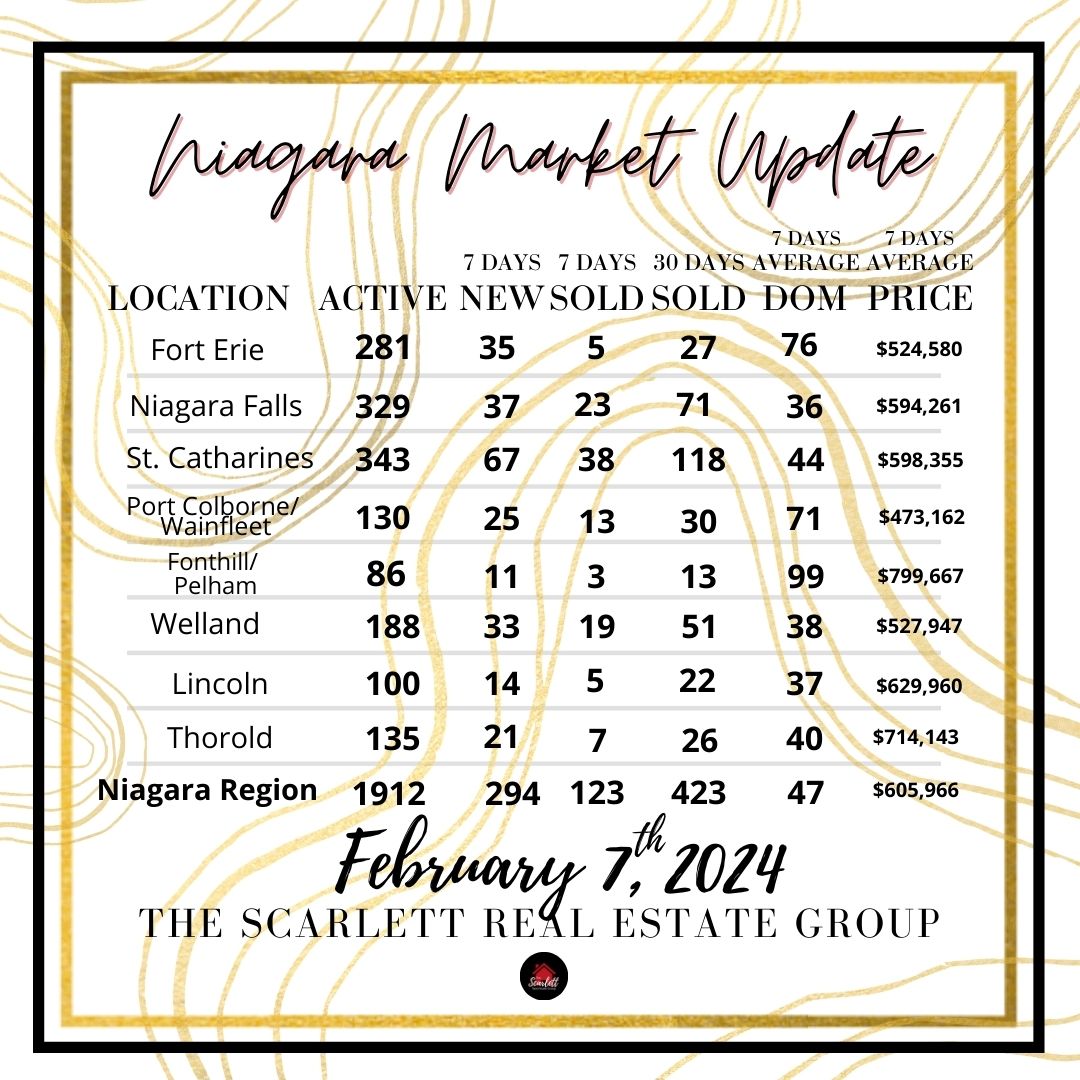

Monday Market Update: Unveiling the Buzz in Fort Erie & Niagara Real Estate

This Monday, we’re diving into the latest trends that are electrifying the Fort Erie and Niagara real estate market. The buzz is real, and for a good reason! From soaring demand to intriguing shifts in buyer preferences, there’s a lot unfolding in this dynamic market space. 📊✨ Ready to get the inside scoop? Make sure to catch the full video on YouTube for an in-depth analysis you won’t want to miss.

What’s Buzzing in Fort Erie & Niagara?

The Fort Erie and Niagara regions are experiencing a whirlwind of activity, drawing attention from both local and out-of-town buyers. With its picturesque landscapes, affordable housing options, and growing community amenities, it’s no wonder the market is buzzing.

Key Trends to Watch

- Soaring Demand: A significant uptick in interest means properties are moving quickly. Discover which areas are seeing the most activity and why.

- Affordability in Focus: Despite the overall market heat, Fort Erie and Niagara continue to offer some of the most affordable housing options in the Greater Toronto Area, making it a hotspot for first-time buyers and investors alike.

- Shifting Buyer Preferences: The pandemic has reshaped what many deem essential in a home. Learn about the rising demand for properties with home offices, outdoor spaces, and more.

Why This Matters to You

Whether you’re considering buying, selling, or simply keeping an eye on the market, understanding these trends is crucial. They not only affect current property values but also hint at future market directions. Staying informed can help you make strategic decisions, whether you’re aiming to find your dream home or looking for the best time to list your property.

Watch the Full Video

For a comprehensive breakdown of the Fort Erie and Niagara real estate market, our latest video on YouTube is your go-to resource. We’ve compiled the latest stats, insights, and expert predictions to give you a clear picture of what’s happening on the ground. From detailed analyses to actionable advice, this video is packed with valuable information tailored for buyers, sellers, and real estate enthusiasts alike.

Don’t let the buzz pass you by! Tune in to our Monday Market Update to stay ahead of the curve in the Fort Erie and Niagara real estate market. The market waits for no one, and this video ensures you’re not just keeping up but leading the pack. Watch now, and dive deep into the trends that are shaping one of the most vibrant real estate markets today. Don’t miss out!

Unleashing Your Inner Strength: A #MotivationMonday Reflection

In the hustle of daily life, it’s easy to lose sight of our own strength, courage, and wisdom. However, A.A. Milne, through the beloved character of Winnie the Pooh, reminds us of a profound truth: “You’re braver than you believe, stronger than you seem, and smarter than you think.” This #MotivationMonday, let’s delve into the essence of this powerful message and how it can transform our perception of ourselves and our capabilities.

Discovering Your Bravery

Bravery isn’t just about heroic acts in extraordinary circumstances. It’s found in the quiet moments of decision-making, in the whispers of your heart when you choose to face your fears rather than flee from them. Remember, every time you confront something that scares you, you’re exhibiting bravery. You’re braver than you believe because you face the world each day, despite its uncertainties and your vulnerabilities.

Acknowledging Your Strength

Strength is often misconceived as a purely physical attribute, but it’s so much more. It’s the resilience you show when faced with life’s challenges, the tenacity to keep going when the road gets tough, and the perseverance to chase your dreams against all odds. You’re stronger than you seem because, in every moment of weakness, there’s an underlying force within you, ready to push through the barriers.

Recognizing Your Intelligence

Intelligence transcends academic achievements and IQ scores. It’s reflected in your daily decisions, your interactions with others, and your ability to learn from experiences. You’re smarter than you think because you navigate the complexities of life with intuition, creativity, and wisdom. Your intellectual depth is not just about what you know but how you apply that knowledge in the real world.

Living the Message

Embracing the essence of Milne’s words means stepping into each day with the confidence that you are capable, resilient, and insightful. It’s about trusting your journey, learning from your experiences, and believing in your ability to overcome challenges. Let this message be a beacon of hope and a reminder of your inherent strengths, especially on days when you feel less than capable.

#MotivationMonday Challenge

This week, challenge yourself to see beyond your perceived limitations. Take a moment to reflect on past instances where you’ve demonstrated bravery, strength, and intelligence. Write these down, celebrate them, and remind yourself of them whenever doubt creeps in. Share this journey with others, encouraging them to recognize their own inner strengths.

A.A. Milne’s timeless words serve as a gentle yet powerful reminder of our inner capacity for courage, resilience, and wisdom. Let this #MotivationMonday be the start of a week where you embrace your true potential, breaking free from the chains of self-doubt. You are braver, stronger, and smarter than you believe, seem, and think. Believe in yourself, for within you lies the power to move mountains.

Sunkissed Memories: A Day at Byron Beach

The essence of summer can be captured in a single, perfect day spent under the warm embrace of the sun, especially at a place as enchanting as Byron Beach. Sunkissed and carefree, my recent adventure to this seaside paradise was a reminder of the simple joys that life offers. Let me take you through a day spent at Byron Beach, a day filled with sunlight, waves, and the spirit of summer.

Morning Serenity

The day began with the soft hues of dawn, painting the sky in pastel colors as the sun peeked over the horizon. The early morning at Byron Beach is a time of tranquility, where the only sounds are the gentle lapping of the waves and the distant calls of seabirds. Walking along the shore, with the cool sand beneath my feet and the salty breeze caressing my face, I felt a profound sense of peace.

Midday Adventures

As the sun climbed higher, the beach came alive with activity. Families setting up for a day of fun, surfers chasing the perfect wave, and couples strolling hand in hand along the water’s edge. I joined in the revelry, basking in the sun’s warmth, the water cool and refreshing against my skin. The laughter of children and the rhythmic sound of the waves provided a soundtrack to a day of blissful relaxation.

Afternoon Delights

By the afternoon, the sun was a golden orb in a cloudless sky, its rays casting a shimmering path across the ocean. It was the perfect time for a picnic, with local delicacies and fresh fruit, enjoying the flavors of summer. As I sat there, surrounded by the beauty of Byron Beach, I felt a deep connection to the moment, to the joy of being alive and immersed in nature’s wonders.

Sunset Reflections

As the day drew to a close, the sky transformed into a canvas of fiery oranges and pinks, a spectacular show of colors that heralded the end of another beautiful day. Watching the sun dip below the horizon, I reflected on the day’s experiences, the laughter shared, and the memories made. Byron Beach, with its stunning landscape and vibrant atmosphere, had given me a day to remember.

Sunkissed and Grateful

Leaving Byron Beach, my skin was sunkissed, and my heart was full. The day under the sun had been a beautiful escape from the everyday, a reminder of the beauty that surrounds us and the pleasure of simple moments. As I looked back one last time, I promised to carry the carefree spirit of Byron Beach with me, a treasure trove of sun-drenched memories to cherish forever.

In the hustle of our daily lives, days like these serve as a poignant reminder of the importance of slowing down, of savoring the warmth of the sun, and of living each moment to its fullest. Sunkissed and carefree at Byron Beach, I was reminded of the beauty of life, a day of sunshine and joy that will linger in my memory long after summer has faded.

Discovering Comfort: What’s Your Favorite Room in Your Home?

Home is not just a place; it’s a feeling, a sanctuary where every room tells a story, reflecting our personality, dreams, and comfort zones. From the cozy corners of a reading nook to the vibrant energy of a kitchen filled with aromas, every space holds a special place in our hearts. But among all these, there’s always that one room that stands out, becoming our ultimate retreat, our favorite spot in the house. 🏡

The Heart of Home

Each room in our home serves a unique purpose, catering to different aspects of our daily lives. The living room, often bustling with activity and laughter, serves as a gathering spot for family and friends. The kitchen, a place of creativity and warmth, where meals are prepared and stories are shared. Bedrooms offer a personal sanctuary for rest and rejuvenation, while home offices provide a quiet space for thought and productivity. And then there are the unique, personalized spaces – a sunroom filled with plants, a library brimming with books, or a workshop echoing with the sounds of creativity.

Why We Love Our Favorite Room

Our favorite room often resonates with our personal needs and aspirations. It could be the kitchen for those who find joy in cooking and sharing meals, the living room for those who love hosting and socializing, or the bedroom for those who cherish privacy and relaxation. Perhaps it’s a personal library for the avid reader, offering a haven of tranquility and escape, or a garden room where the connection with nature brings peace and inspiration.

The Emotional Connection

The bond we share with our favorite room goes beyond its physical attributes. It’s about the memories created, the comfort it provides, and how it reflects our identity. It’s the room where we feel most at ease, where we can truly be ourselves. Whether it’s the soft glow of morning light through the curtains, the perfect chair that cradles us during long reading sessions, or the kitchen table that has witnessed countless family discussions, it’s these emotional connections that truly make a room our favorite.

Share Your Story

Now, it’s your turn to share – what’s your favorite room in your home and why? Is it the place where you find solace after a long day, the spot where creativity flows, or the corner filled with memories and laughter? Comment below and let us delve into the diverse sanctuaries that our homes offer, celebrating the unique stories and emotions that each favorite room holds. Let’s uncover the beauty of our personal spaces and the reasons they hold such a special place in our hearts. 🏡

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link