A major financial shift is quietly approaching the Canadian housing market.

Over the next two years, a large percentage of mortgages will come up for renewal — many of them originally secured during historically low interest rate periods.

For homeowners, this may mean higher monthly payments.

For buyers, it could create new opportunities.

For the housing market overall, it introduces an important question:

Will mortgage renewals increase housing supply?

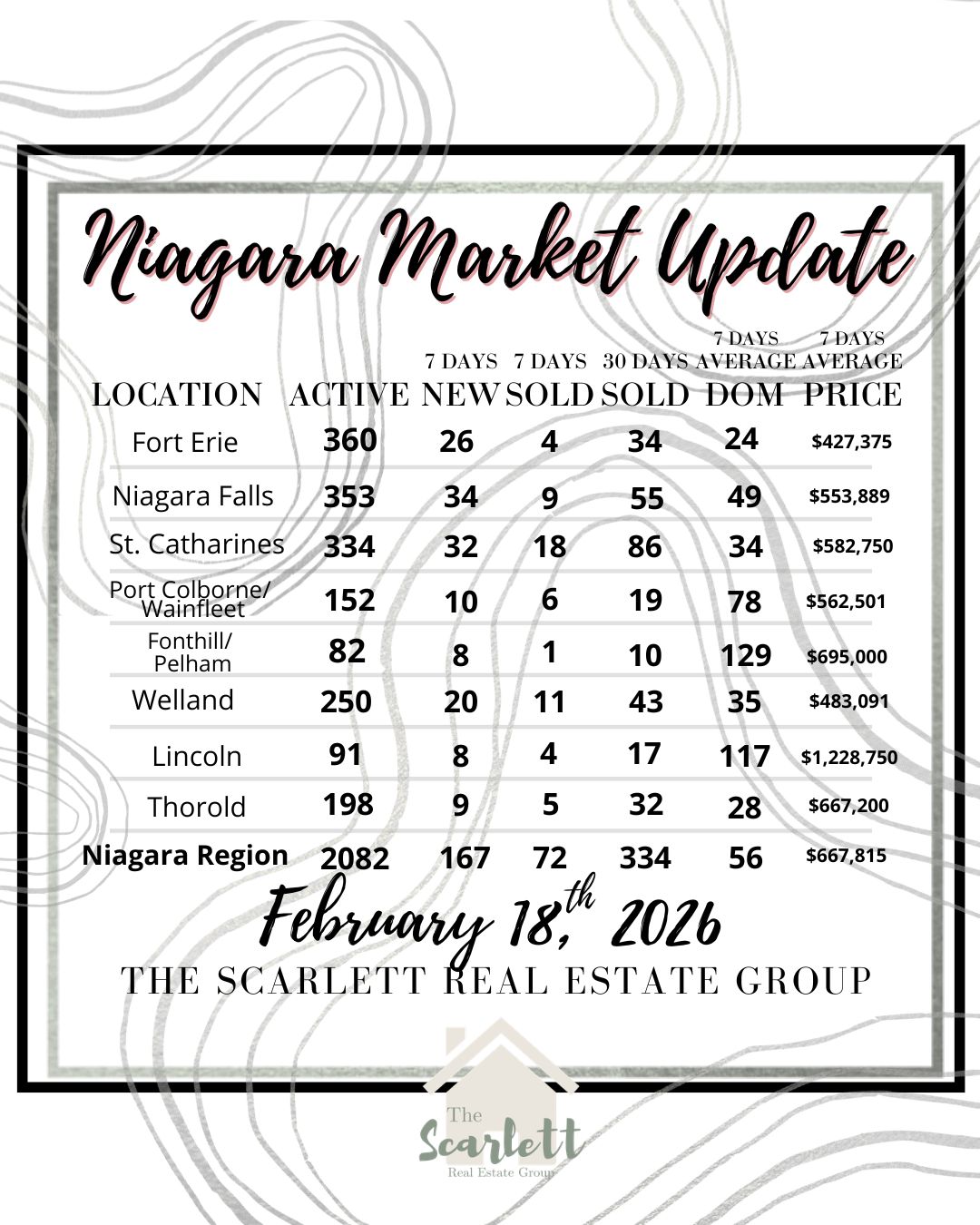

Let’s take a closer look at what this could mean locally across Fort Erie and the Niagara region.

Why Mortgage Renewals Are Getting Attention

Between 2020 and early 2022, borrowing costs were unusually low. Many buyers locked into fixed mortgage rates well below today’s averages.

As those terms expire, homeowners may face payment increases depending on their remaining balance and new financing terms.

Even modest rate changes can alter household budgets — particularly when combined with rising insurance, utilities, and general living expenses.

This is why economists, lenders, and housing analysts are watching renewals closely.

Understanding the Payment Shift

When a mortgage renews at a higher rate, several outcomes are possible:

- Monthly payments increase

- Amortization periods are extended

- Lump-sum payments are made to reduce balances

- Some homeowners refinance

- Others consider selling

Most homeowners prepare well in advance, but not every household has the same financial flexibility.

For some, renewal will simply be a routine process.

For others, it may trigger a housing decision.

Will Renewals Create More Listings?

This is one of the most common questions in real estate right now.

The answer is nuanced.

Mortgage renewals alone do not automatically lead to a surge in listings. However, they can gradually contribute to increased supply — particularly when combined with other life events such as relocation, retirement, or family changes.

Rather than a sudden wave of homes hitting the market, experts typically expect a steady flow.

This type of measured increase tends to support a balanced marketplace rather than disrupt it.

What This Could Mean for Pricing

Housing prices are influenced by the relationship between supply and demand.

If more homes become available:

- Buyers gain additional choice

- Negotiation conditions may normalize

- Pricing growth may remain measured

However, demand remains an important counterbalance.

Population growth, lifestyle migration, and regional affordability continue to attract buyers to communities across Niagara.

Because of this, any pricing impact is more likely to be gradual than dramatic.

Fort Erie’s Position Within the Region

Fort Erie has developed a reputation as a lifestyle-driven market.

Buyers are often drawn by:

- Access to waterfront areas

- Proximity to larger urban centers

- Cross-border convenience

- Relative affordability compared to major cities

These factors help sustain long-term demand — even during periods of broader market adjustment.

As a result, while mortgage renewals may introduce more listings, they are unlikely to define the market on their own.

Not Every Renewal Creates Financial Pressure

It is important to avoid broad assumptions.

Many homeowners have benefited from years of property value growth. Others have reduced their mortgage balances significantly since purchasing.

Some households will absorb higher payments with minimal disruption.

In addition, lenders frequently offer options designed to ease transitions, including adjusted amortization schedules.

The renewal story is not one-size-fits-all.

Buyers Are Watching Closely

Informed buyers understand that periods of market transition can present opportunity.

When inventory expands:

- Selection improves

- Decision-making pressure often decreases

- Negotiation conditions may become more balanced

This can encourage thoughtful purchasing rather than reactive bidding.

For buyers who felt sidelined during highly competitive periods, the evolving environment may feel more approachable.

Sellers Still Hold Strategic Advantage When Prepared

Even in markets influenced by mortgage renewals, preparation continues to shape outcomes.

Homes that are well-priced, properly presented, and aligned with buyer expectations tend to generate stronger activity than those that rely solely on timing.

Today’s buyers are informed.

They study listings, compare values, and assess condition carefully.

Success often comes down to strategy rather than circumstance.

A Gradual Shift — Not a Sudden Correction

Historically, housing markets adjust over time rather than through abrupt swings.

Mortgage renewals represent one piece of a broader economic landscape that includes:

- Interest rate direction

- Employment trends

- Consumer confidence

- Migration patterns

- Construction levels

Because multiple factors interact simultaneously, the most likely outcome is moderation — not disruption.

Watching Inventory Levels Matters

Inventory remains one of the clearest indicators of market health.

If renewal-driven listings increase steadily while buyer demand remains active, the result is often a more balanced environment.

Balanced markets tend to support:

- Stable pricing

- Predictable negotiation conditions

- Measured transaction timelines

This type of stability benefits both buyers and sellers by reducing uncertainty.

Planning Ahead Is the Strongest Position

For homeowners approaching renewal, early preparation is valuable.

Consider reviewing:

- Current mortgage terms

- Estimated renewal rates

- Household budget flexibility

- Equity position

- Long-term housing goals

Understanding these variables well before renewal dates allows for informed decision-making rather than reactive choices.

Equity Still Plays a Major Role

Many Niagara homeowners have accumulated meaningful equity over the past decade.

Equity provides options.

Some owners may choose to:

- Downsize

- Move closer to family

- Transition into lifestyle communities

- Purchase newly built homes

- Reduce monthly expenses

In these cases, renewal becomes less about financial strain and more about opportunity.

What Buyers Should Watch For

If you are considering a purchase in the next 12–24 months, mortgage renewals are worth monitoring — but not fearing.

Key indicators include:

- New listing volume

- Days on market

- Price adjustments

- Conditional vs. firm sales

- Absorption rates

When analyzed together, these metrics provide a clearer picture than headlines alone.

Niagara Continues to Attract Attention

The region’s long-term fundamentals remain notable:

-

- Continued infrastructure investment

- Lifestyle-driven migration

- Access to waterfront communities

- Relative affordability compared to larger metropolitan markets

- Strong appeal for retirees, professionals, and remote workers

- Proximity to the U.S. border

These drivers help support consistent housing demand — an important stabilizing force even as financial conditions evolve.

Renewal Does Not Automatically Mean Selling

One misconception worth clarifying is that higher payments force immediate sales.

In reality, homeowners typically explore several paths before listing, including restructuring their mortgage or adjusting spending priorities.

Selling is usually a considered decision rather than a rushed one.

Because of this, the market impact tends to unfold gradually.

A Market Defined by Preparation

Whether buying or selling, the coming cycle will likely reward preparation.

For sellers, this means entering the market with clear pricing and presentation.

For buyers, it means understanding affordability and acting decisively when the right property appears.

For homeowners nearing renewal, it means reviewing options early.

Preparation creates flexibility — and flexibility supports stronger outcomes.

Looking Ahead

Mortgage renewals will remain part of the housing conversation throughout 2026 and beyond.

Yet they represent evolution, not instability.

Real estate markets are designed to adjust as financial conditions change.

When supply expands modestly and demand remains steady, the result is often a healthier environment for everyone involved.

Final Thought

Periods of transition tend to generate headlines, but local context always matters.

Fort Erie and the broader Niagara

region continue to show the characteristics of a resilient housing market — steady interest from buyers, lifestyle appeal, and long-term growth drivers that extend beyond short-term financial cycles.

Mortgage renewals will influence some decisions, but they are unlikely to define the entire marketplace.

What they will do is encourage more thoughtful planning.

And thoughtful planning typically leads to stronger real estate outcomes.

What This Means for You

If your mortgage is renewing soon, this is an ideal time to review your position and understand your options.

If you are considering a purchase, watch inventory trends and be prepared when opportunities appear.

If selling is on your horizon, strategy will matter more than ever — pricing, preparation, and timing remain critical factors in attracting serious buyers.

The market is not signaling urgency.

It is signaling awareness.

Staying Informed Locally

National housing stories provide context, but real estate is ultimately local.

Conditions can vary significantly between provinces, regions, and even neighbourhoods.

Tracking data specific to Fort Erie and Niagara helps ensure decisions are based on what is actually unfolding in the communities where people live and move.

As the year progresses, key indicators to monitor include:

-

-

- Inventory growth

- Sales pace

- Average price movement

- Buyer activity across price segments

- Renewal-driven listings

These patterns will provide early insight into where the market is heading.

Conclusion

Mortgage renewals are part of the natural rhythm of homeownership.

While they may introduce additional listings over time, they also create movement — and movement supports an active, functioning marketplace.

For buyers, this can mean increased choice.

For sellers, it reinforces the importance of entering the market prepared.

For homeowners, it is a reminder that proactive planning leads to better financial decisions.

The months ahead will likely bring continued adjustment rather than disruption — a market finding its balance as financial conditions normalize.

Call to Action

If you would like to better understand how mortgage renewals — and other emerging trends — could influence your property or future plans, staying informed is the first step.

Watch my Value Series on Instagram or YouTube for ongoing insights into the Fort Erie and Niagara real estate market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Greater buyer choice

Greater buyer choice

Bidding wars at scale

Bidding wars at scale